The Walt Disney Company’s board of directors has recently come under pressure from activist investors seeking to gain influence over the company. Two activist hedge funds, Trian Partners and Blackwells Capital, have put forward nominations for Disney’s board in an attempt to advance their agendas.

Disney’s board opposes the nominations from Trian Partners and Blackwells Capital, arguing that the candidates lack the necessary qualifications and expertise to guide the company.

Disney Descendants Support the Current Board

In an open letter, the grandchildren of Walt and Roy Disney voiced their support for Bob Iger and Disney’s current board of directors.

They argued that the activist investors threatening Disney lack an understanding of the company’s legacy and mission. The descendants expressed concern that the activist hedge funds are primarily interested in short-term profits rather than the long-term success of Disney.

Who Are the “Villains” in This Situation?

The “villains” referred to in the letters issued by Walt Disney’s grandchildren are activist investors like Nelson Peltz, who aim to gain board seats and influence strategic decisions at The Walt Disney Company.

As stated in one letter, “What concerns us most about these hedge-fund-backed opportunists is that they have little to no knowledge of what Disney truly means to people like you.

Disney’s Grandchildren Speak Out in Support of Bob Iger

The grandchildren of Disney have voiced their support for Bob Iger, the Chief Executive Officer of The Walt Disney Company, and the company’s current leadership.

The signatories of the first letter include filmmaker Abigail E. Disney, who has previously voiced concerns over issues like executive compensation.

A Brief History of Disney

In 1923, brothers Walt and Roy Disney founded the Disney Brothers Cartoon Studio. For the next four years, Walt created his Alice Comedies series. In 1926, the company’s name was changed to Walt Disney Studio. The studio started to gain recognition with the creation of Oswald the Lucky Rabbit.

However, Walt lost the rights to Oswald, spurring the creation of Mickey Mouse in 1928. In 1937, Disney released its first full-length animated film, Snow White and the Seven Dwarfs, establishing the studio as one of the leaders of animated film.

Key Background on Nelson Peltz and His Fund

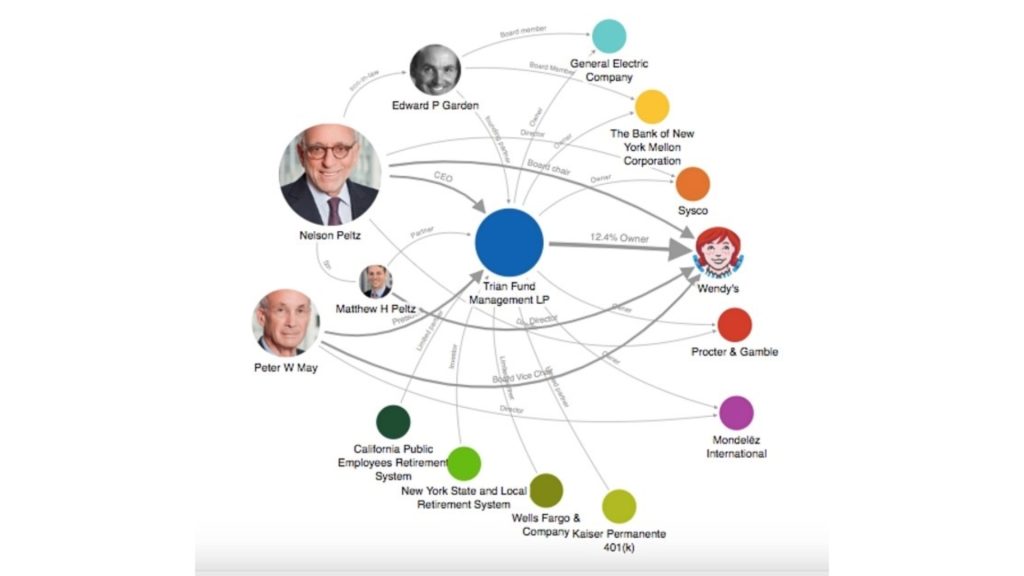

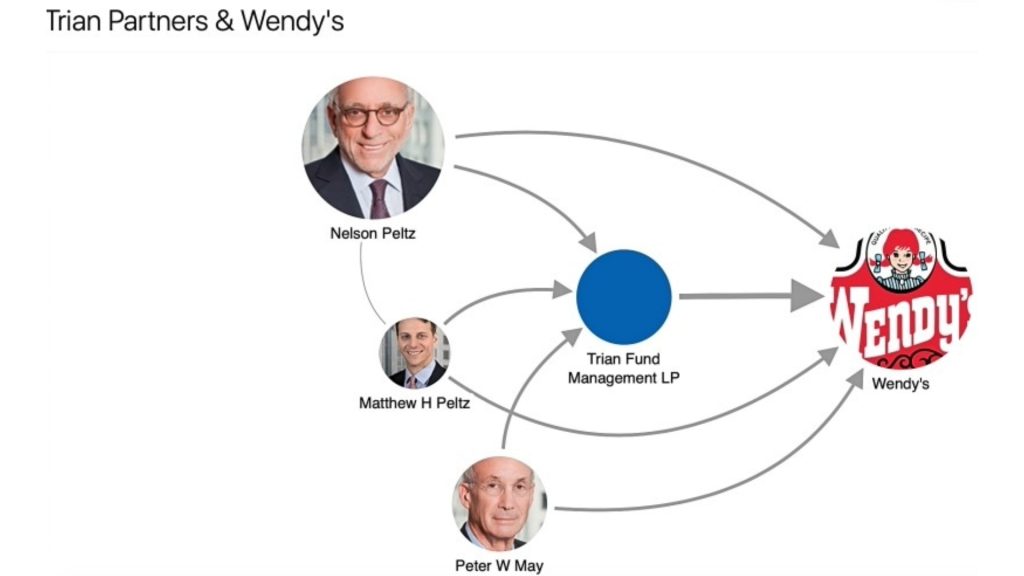

Nelson Peltz co-founded Trian Fund Management in 2005. Trian Fund Management now has $8.5 billion in assets under management. Peltz is an activist investor worth approximately $1.4 billion.

Trian targets companies that it believes are underperforming and pushes for changes to increase shareholder value, such as cost cutting, restructuring operations, or management changes. Trian has been involved in proxy fights with companies like H.J. Heinz Company, Cadbury Schweppes, and Wendy’s International.

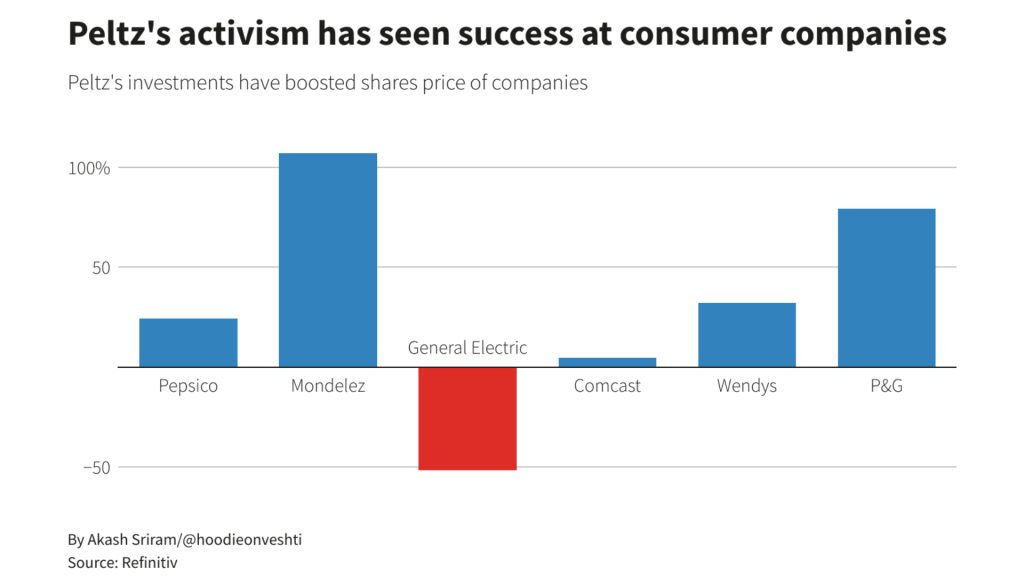

Peltz’s Track Record With Consumer Companies

Nelson Peltz, the activist investor who runs hedge fund Trian Partners, has a long history with consumer-focused companies. His track record in the sector, however, is mixed. As a director on Sysco’s board from 2006 to 2021, Peltz’s hedge fund underperformed the S&P 500 by 2.88% annually, indicating questionable strategic decisions.

Nevertheless, Peltz was instrumental in reorganizing Procter and Gamble as a board member, working with P and G’s management to streamline its brand portfolio and cut costs. Trian, Peltz’s hedge fund, currently has built stakes in consumer-focused companies like PepsiCo, Mondelez International, and The Wendy’s Company.

Proponent For Rapid Change Over Sustainability

Peltz and Trian have been criticized for their aggressive, short-term focus and for installing underqualified directors on company boards. Their bids to win board seats are often contentious, as they were in proxy fights at companies like DuPont, Legg Mason, and Wendy’s.

Peltz’s experience with consumer companies is extensive but polarizing. His strategies have led to both successes and controversies that call into question whether his objectives align with shareholder and company interests in the long run.

Why Is Nelson Peltz Interested In Disney

Nelson Peltz, founder of Trian Fund Management, has nominated himself and former Disney CFO Jay Rasulo to join Disney’s Board of Directors. According to Trian, Peltz aims to work with Disney’s management team to continue driving growth and increase shareholder value.

Trian points to its track record of success at companies like Procter and Gamble, Heinz, and Mondelez as evidence it can help Disney thrive. However, Disney’s Board has rejected Trian’s nominees, stating they lack “the appropriate range of talent, skill, perspective and/or expertise to effectively support Disney’s building priorities.”

The Letter from Roy O. Disney’s Grandchildren

Nine grandchildren of Walt and Roy Disney expressed their unequivocal support for Bob Iger and The Walt Disney Company’s incumbent board of directors in an open letter to shareholders.

The letter expressed concern that “hedge-fund-backed opportunists” were attempting to gain influence over Disney to generate a quick profit rather than maintain its magic. According to the grandchildren, their grandfather Roy would be proud of Disney’s impact today but worried by the threat posed by these so-called activist investors.

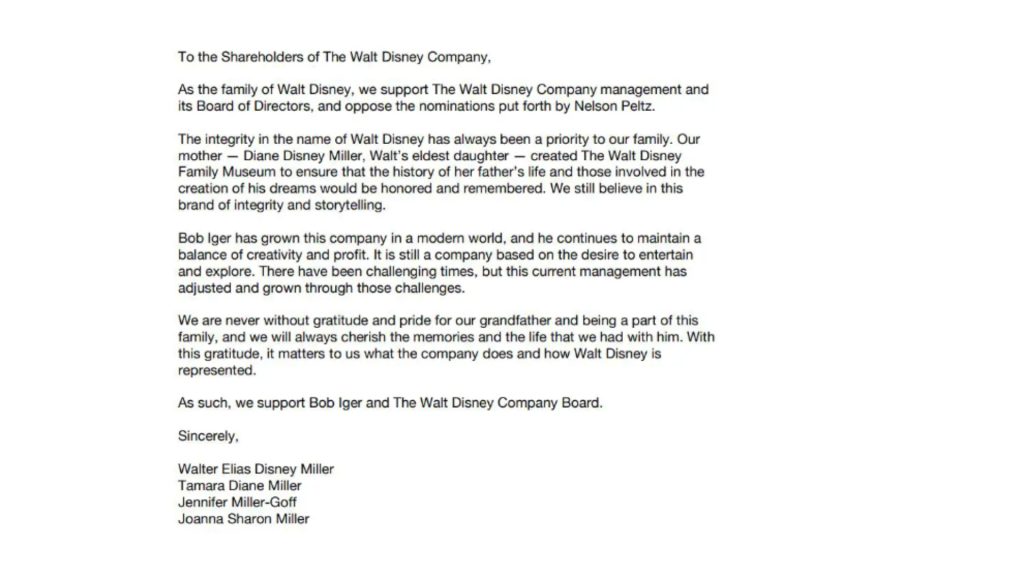

The Letter from Diane Disney Miller’s Children

The four children of Diane Disney Miller, Walt Disney’s elder daughter, authored a letter conveying their support for Bob Iger and The Walt Disney Company’s Board of Directors.

They expressed opposition to the nominations proposed by activist investor Nelson Peltz, citing concerns over the candidates’ lack of knowledge and understanding of the company’s history and values. The letter acknowledged that the family members do not always see eye to eye with the company’s leadership. They felt confident that Walt Disney would be proud of what Disney means to people today.

What This Means for Disney’s Future Direction

If shareholders side with the activist investors at the upcoming meeting, Disney’s future direction could shift toward a narrow focus on short-term gains. However, if Iger and the current board remain in control, Disney is more likely to keep balancing business and brand as it has under Iger’s leadership.

The company would probably continue acquiring major entertainment properties and creating emotional connections with new generations, suggesting a steady, long-term rise in stock value.

Potential Outcomes of the Shareholder Vote

The upcoming shareholder vote will determine the fate of Disney’s board of directors and, to some extent, the company’s strategic direction. If shareholders vote to retain the current board, Disney is likely to maintain its current trajectory under Bob Iger’s leadership.

Alternatively, shareholders may vote for activist investors’ board nominees. This outcome could disrupt Disney’s strategy and leadership, creating uncertainty.

Impact on Disney Parks and Resorts

The Walt Disney Company has seen exponential growth in revenue and impact over the last decade, largely driven by expansion and improvements at Walt Disney World Resort and other theme park destinations.

Through careful stewardship of an unparalleled portfolio of intellectual properties and a dedication to technological innovation, The Walt Disney Company has achieved remarkable success in translating the magic of Disney into extraordinary guest experiences at its theme park resorts and destinations around the world.

A Highlight of Complex Corporate Issues

The ongoing tensions between Disney shareholders and activists highlight complex issues around corporate responsibility and governance. While Abigail Disney and others have raised important concerns, Bob Iger and senior leadership maintain they are acting ethically and responsibly.

It remains to be seen whether internal activism can drive meaningful change or if external regulatory and social pressures may be required to compel Disney to re-examine its policies and priorities.