The legal liability faced by the owner and manager of the container ship, the Dali, that collided with the Francis Scott Key Bridge in Baltimore could reach into the billions, especially when the costs to clean up and rebuild the collapsed bridge are factored in.

In an attempt to cap the liability, the owner and manager of the container ship are invoking an old maritime law dating back to 1851 … a law that was used by the Titanic’s owners after the 1912 sinking.

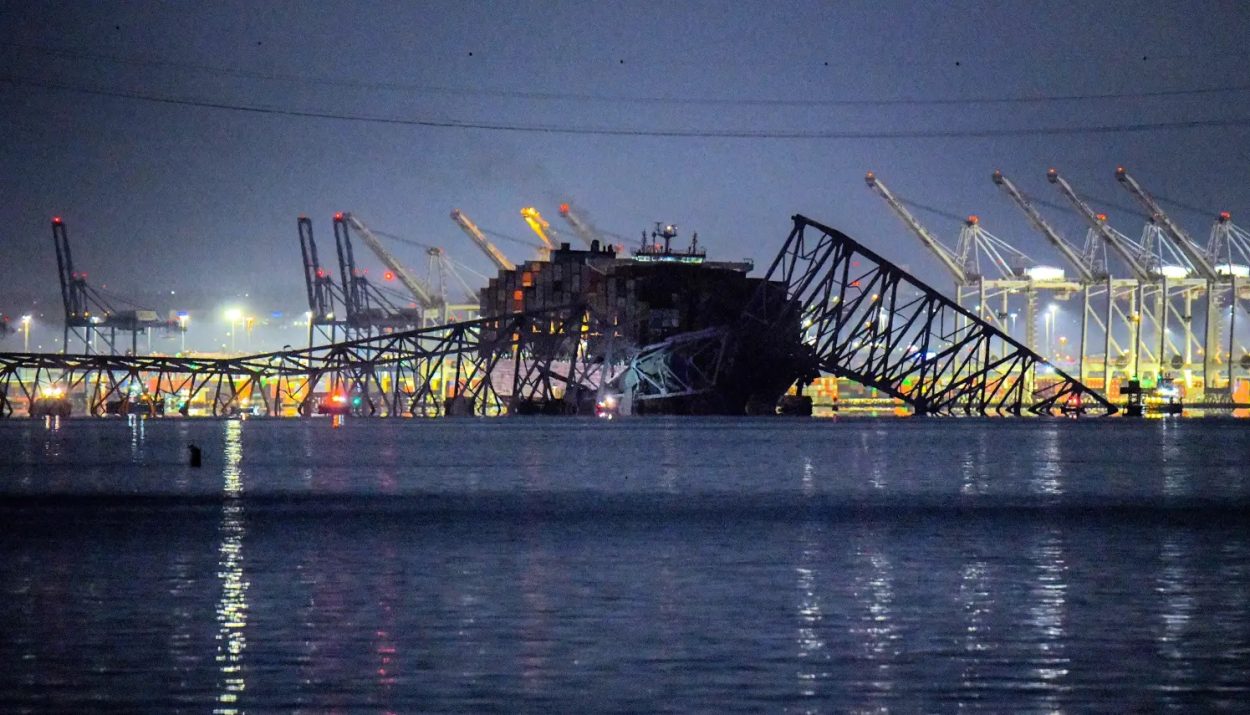

A Catastrophic Collision and Collapse

On March 26, 2024, just before 1:30 a.m., the container ship, Dali, leaving the Port of Baltimore experienced a total electrical failure. Unable to steer or control the vessel, the ship’s pilot alerted the Maryland Transportation Authority Police that they were heading toward a support structure under the Francis Scott Key Bridge.

The MTAP, in turn, ordered officers to stop traffic on the Key Bridge. Moments later, the Dali struck the support structure. The impact caused a catastrophic collapse of the bridge. Six maintenance workers on the bridge were killed when the bridge collapsed.

The Key Bridge, a Key Thoroughfare

Named for Baltimore native Francis Scott Key who penned the words to “The Star-Spangled Banner” in 1814, the Key Bridge spanned the Patapsco River and the outer portion of Baltimore Harbor. I-695, also called the Baltimore Beltway, crossed the bridge.

A vital thoroughfare in Baltimore, the Francis Scott Key Bridge connected Baltimore’s Hawkins Point neighborhood and Baltimore County’s Dundalk neighborhood. It was an important route for the shipping industry. Nearly 5,000 trucks crossed the Key Bridge each day.

Closing the Port of Baltimore

In addition to the destruction of the Francis Scott Key Bridge, the collision forced authorities to close the Port of Baltimore. According to Maryland governor, Wes Moore, the closure of the Port of Baltimore will greatly impact the state’s economy.

The closure affects more than 8,000 workers and will have an economic loss of about $15 million per day for every day that the Port of Baltimore is closed. It cannot be reopened until the debris from the bridge is removed.

The Dali, her Owner and Manager

The Dali, the container ship that collided with the Key Bridge, was registered in Singapore. It was owned by Grace Ocean Private Ltd. and managed by Synergy Marine Group. The Dali, which was built in 2015, was 980 feet long.

After the collision, it was revealed that the Dali had passed 27 inspections at various ports around the world since it was built. In 2023, it underwent two global inspections – one in Chile in June and another in New York in September – and passed them both. The collision with the bridge, by all accounts, was simply a tragic accident, albeit an expensive one.

A Billion-Dollar Accident

According to experts and economists, the final tally for the Key Bridge accident could reach as high as $4 billion. The Key Bridge alone was worth $1.2 billion, and it will need to be completely rebuilt. Then there are the clean-up efforts, wrongful death lawsuits on behalf of the six workers who were killed, and roughly $15 million per day in lost revenue due to the port closure.

The owner of the Dali, Grace Ocean, placed the value of the ship, prior to the accident, at $90 million. The freight it was hauling was valued at $1.2 million. You don’t need to pull out your calculator to see that the total dollar amount is astronomical.

An Old Maritime Law Make Come into Play

Both Grace Ocean and Synergy Marine have filed a petition on Monday that would, if approved, limit their legal liability to $43.7 million. In this petition, the two companies are basing their figure on an old maritime law that was enacted in 1851, nearly two centuries ago.

Rule F of the Supplemental Rules For Admiralty or Maritime Claims of the Federal Rules of Civil Procedure limits liability to the value of the ship after the accident. This rule was approved on March 3, 1851.

A U.S. Law for a Singapore Ship

The petition further claims that this U.S. maritime law applies to the Dali, even though the container ship was registered in Singapore. The attorneys for Grace Ocean and Synergy Marine stated in the claim that the “venue is proper in this District.”

They contend that the “vessel that is the subject of this action is presently located within this judicial district.” Because the accident happened in the United States, they are bound by the laws and maritime rules of the U.S.

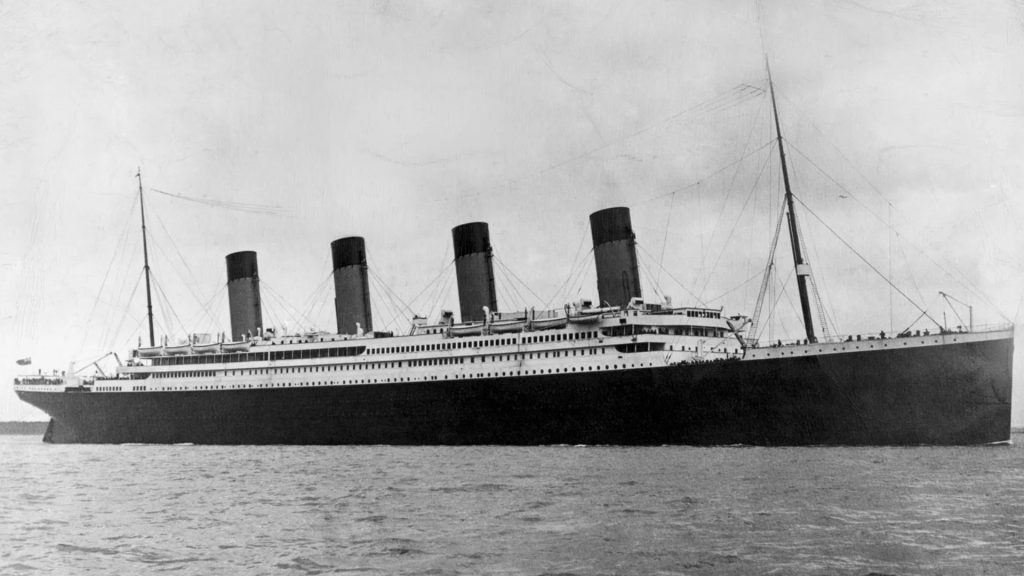

The Titanic’s Owners Also Invoked this Law

Thanks to that epic Leonardo DiCaprio film, most people know that the RMS Titanic, a state-of-the-art luxury liner, sank on its maiden voyage on April 15, 1912, killing 1,496 people. The movie, however, didn’t mention the numerous lawsuits that were filed after the disaster, nor the ensuing transatlantic legal battles.

American claimants involved in the incident filed their lawsuits against the Oceanic Steam Navigation Company, White Star Line’s parent company, in the District Court of Southern District of New York. Since these claims were filed in a court based in the United States, the attorneys for the Oceanic Steam Navigation Company argued that American rules should be used, rather than British ones.

A Move to Limit Liability

By invoking the maritime laws of the United States, the liability for the Titanic’s sinking would be capped at $91,805.54. This was the total value of the thirteen lifeboats and recovered freight. Judge Holt of the District Court ruled against this, but the Oceanic Steam Navigation Company filed an appeal in the U.S. Supreme Court.

In 1914, the Supreme Court ruled that the U.S. maritime liability limits law did apply to the case of the Titanic lawsuits. The numerous claims, which amounted to more than $16 million, were settled in 1916 for a total of only $664,000.

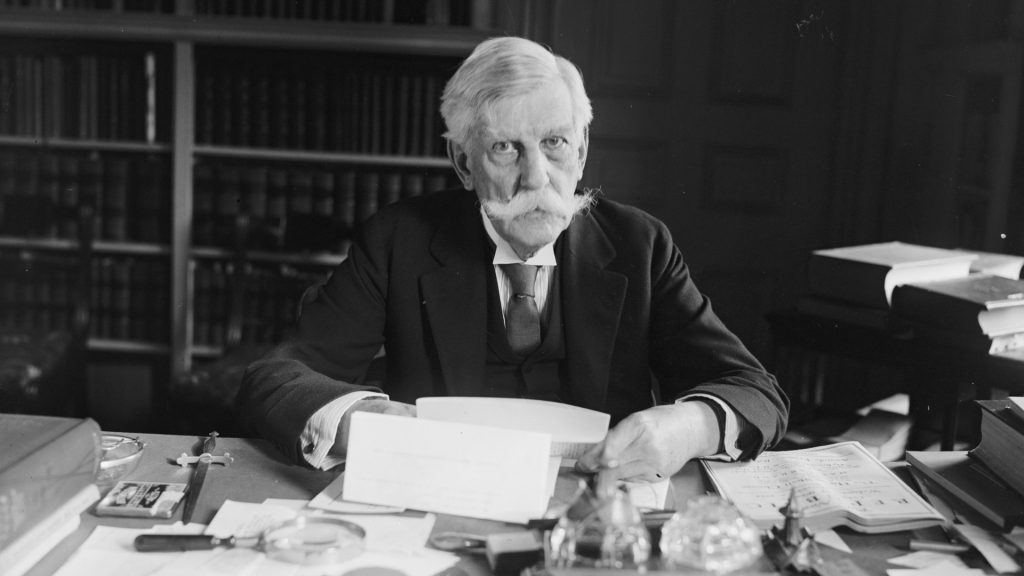

Oliver Wendell Holmes Has His Say

Supreme Court Justice Oliver Wendell Holmes wrote the Supreme Court’s opinion. In it, he stated, “It is true that the foundation for a recovery upon a British tort is an obligation created by British law. But it is also true that the laws of a forum may decline altogether to enforce that obligation on the ground that it is contrary to domestic policy.”

He continued, “It is competent, therefore, to Congress to enact that, in certain matters of admiralty jurisdictions, parties to our courts shall recover only to such extent or in such way that it may mark out.”

Stipulations of the Maritime Law

According to Michael Sturley, a professor at the University of Texas at Austin’s School of Law and an expert in maritime law, there are some stipulations that apply to the 1851 law that limits liability.

He explained that both companies filing the petition, Grace Ocean and Synergy Marine, would have to prove that they were not at fault for the accident. Furthermore, they would have to establish that they had no knowledge of negligence or other factors or conditions that could have led to the incident.

“Regularly Invoked”

Sturley noted that the petition will hinge on the findings of the official incident investigation, which could take months, even years, to complete. But if the petition is granted, both Grace Ocean and Synergy Marine could save a considerable amount of money on claims.

He stated that this 1851 maritime law limiting liability “is regularly invoked” but he added that it is “much less often successful.” Expert analysts expect that the Key Bridge collision and collapse could result in insurance claims totaling billions of dollars. This could be the most costly single marine incident in history.