When most modern shoppers hear the phrase “Black Friday,” they think of massive discounts and possible violence at your favorite department store. American consumerism has given the phrase “Black Friday” a new significance, but before the day after Thanksgiving became one of the biggest shopping days of the year, it referred to a different day, and a different scandal in the nineteenth century.

Financial Corruption Now, Financial Corruption Then

The financial system in America looked very different in the 19th century. Most money was based on the gold system, and the stock market held just as much sway over the economy as it does today. Stock brokers had the chance to make enormous amounts of money by trading stocks, especially if they were willing to do it unethically.

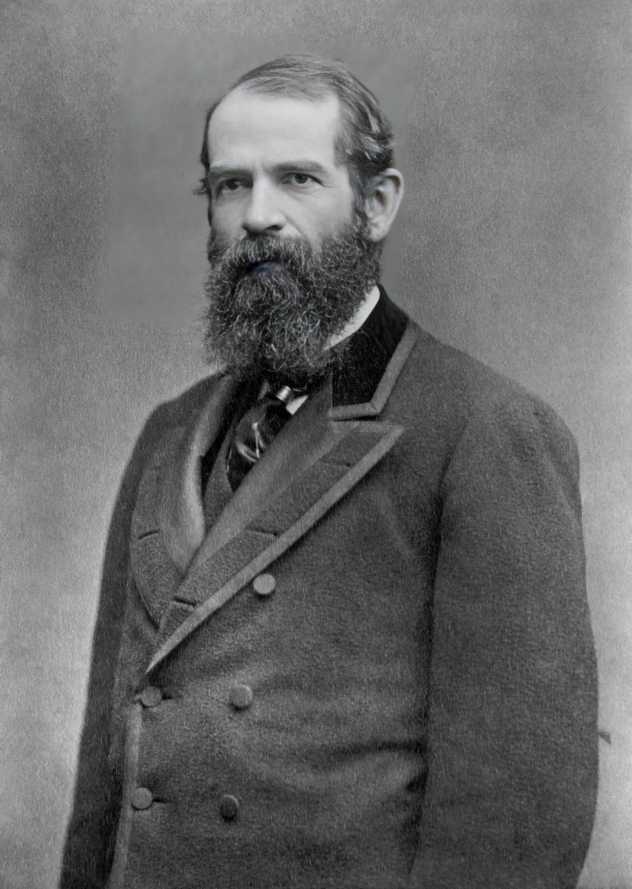

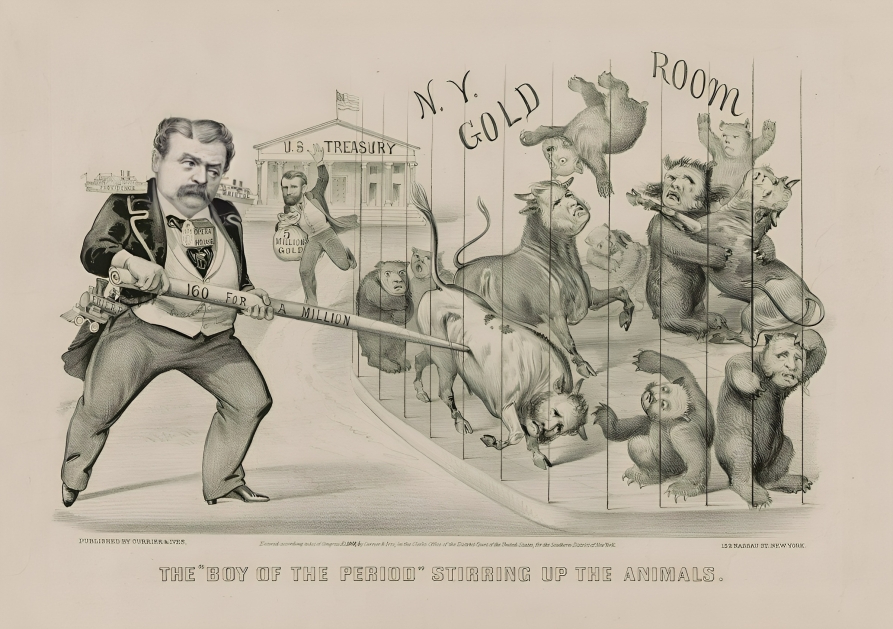

Two such brokers, Jay Gould and Jim Fisk, were known as two of the most ruthless financial masterminds on Wall Street. They went to any length to make money, including selling fraudulent stocks and bribing politicians and judges. Gould particularly loved to come up with new ways of gaming the system, and was once called the “Mephistopheles of Wall Street.”

Gould Sets His Eyes on the Gold Market

One of Gould’s most ambitious targets for corruption was the United States financial system itself. Specifically, the gold market. Gold was still the standard for international trade, but the United States had veered off the gold standard during the Civil War, issuing $450 million in government-back “greenbacks” to fund the Union march.

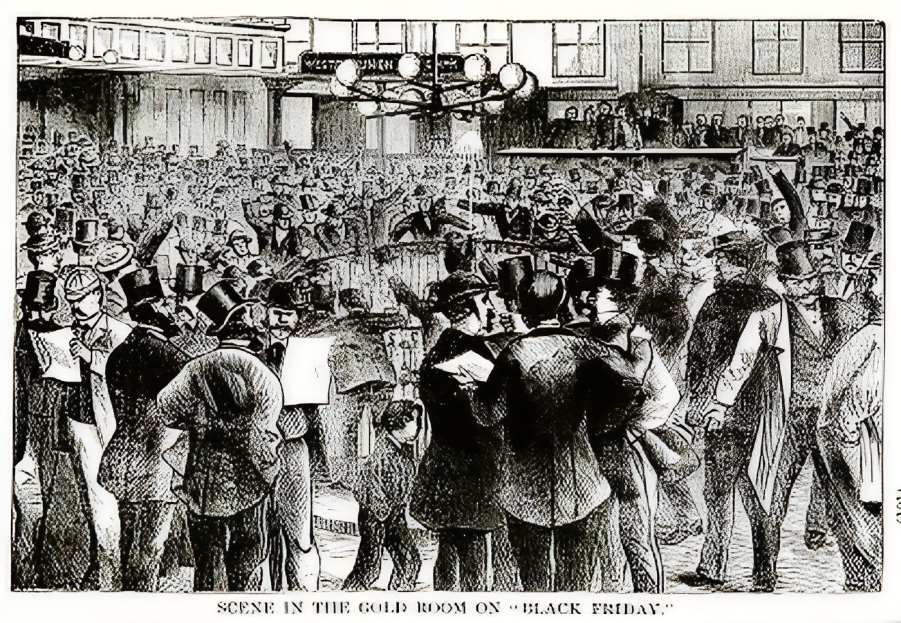

Gold and greenbacks were competing in circulation at the time of Gould’s scheme, and the government had formed a special “Gold Room” on Wall Street where the currency could be traded. Since there was only about $20 million in gold in circulation at the time, Gould theorized that if one could own a majority, he could control the market price.

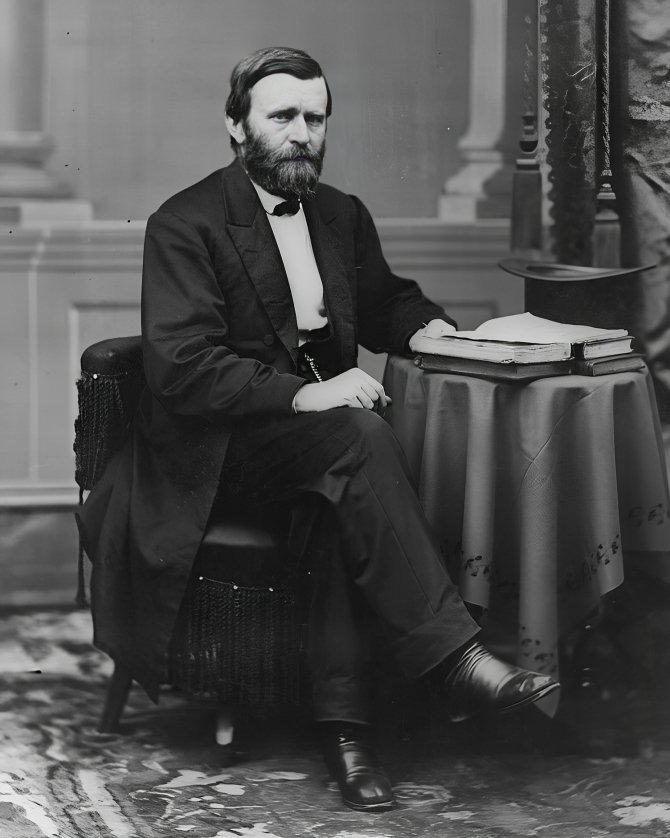

The President Was in the Way

There was one significant hurdle to Gould’s speculating plan. The president at the time, Ulysses S. Grant, had continued the Treasury policy of using gold to buy greenbacks from the public, essentially controlling the price of gold. When the government sold their shares, the price went down, and vice versa.

This was obviously a hurdle to Gould’s money making scheme. In order for him to make a profit by cornering the market on gold, he would need the government to remain unaware, and to keep a tight hold of their own reserves. So he turned to an ally.

Connections in New York, Connections in Washington

Gould turned to Abel Corbin to aid in his scheme, a former Washington bureaucrat who happened to be married to Jennie Grant, President Grant’s sister. Gould bribed Corbin with $1.5 million in gold to aid in his scheme, and that summer, Corbin began his half of the scheme.

In order to keep the government unaware of what they were doing, Corbin helped install General Daniel Butterfield as the U.S. sub-treasurer of New York. Butterfield was bribed to inform Corbin of any advance notice of the government selling gold, and Corbin used his connections to convince President Grant that high gold prices would benefit U.S. farmers.

Bribery was the Name of the Game

The bribery and manipulation paid off. In early September, President Grant confided in Corbin that he wasn’t planning on selling any government reserves during the month. It was the news that Gould and his team had been waiting for, and the plan was on.

Unbeknownst to the government or anybody else, Gould and his team had been stockpiling gold for weeks when the news came in. They were thrilled; in August, a $100 gold piece had sold for around $132 in greenbacks, but as they bought more and more gold behind fake names and disguises, the price climbed as high as $141 a piece.

The President Finally Catches Wind

Brokers and gold short sellers were feeling the squeeze and, distraught, they wrote the government to ask them to intervene on the “ring” who were trying to bull up the market. Unknown to anyone, Gould and Fisk had come to own a combined $60 million in gold, which was three times the public supply in New York.

Gould and his team continued buying up the gold supply and driving up prices until September 22, when Corbin discovered the president was on to them. Earlier in the month he had written Grant to ensure his non-interventionist stance on gold, but it was the final straw that tipped the president off to their scheme.

The Stage Is Set

Instead of sharing the new information with his fellow conmen, Corbin instead chose to step away from the scheme. On September 23, he started to quietly sell his own shares of gold, and by September 24, the day that would come to be known as “Black Friday,” the stage was ripe for a showdown between Gould, Fisk, and the government.

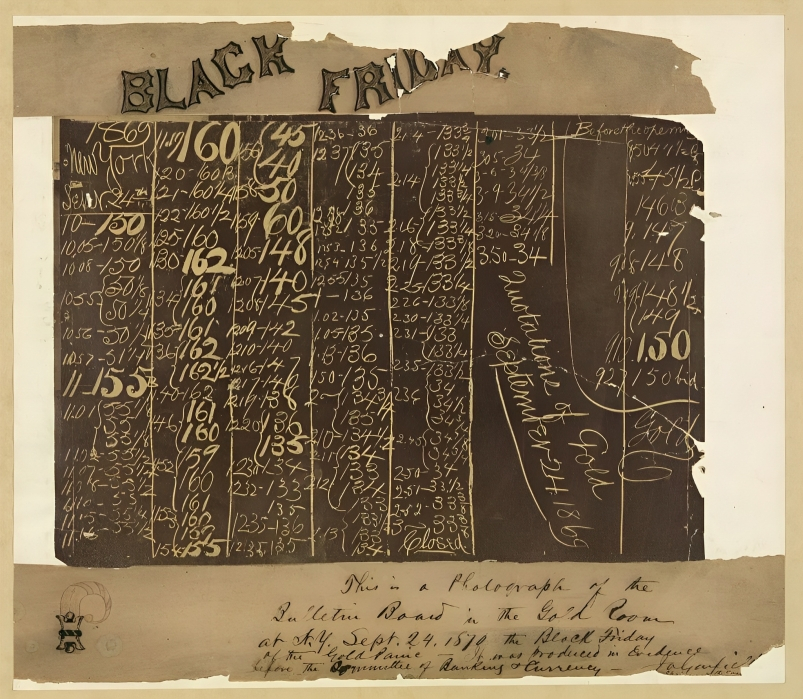

Gould’s scheme had turned the market upside down. The day before, gold had closed at $144.50 a piece, but when the market opened the next day, it jumped to $160 a piece. Gould continued to buy up the market, thinking that nothing was wrong, and bragging that gold would soon reach $200 a piece.

An Announcement to End the Scheme

That same day, President Grant met with the Treasury secretary of the United States and they resolved to bust the scheme by flooding the gold market with $4 million in sales the next day. The news had the desired effect of loosening Gould and Fisk’s hold on the market, but it also sent Wall Street into a tailspin.

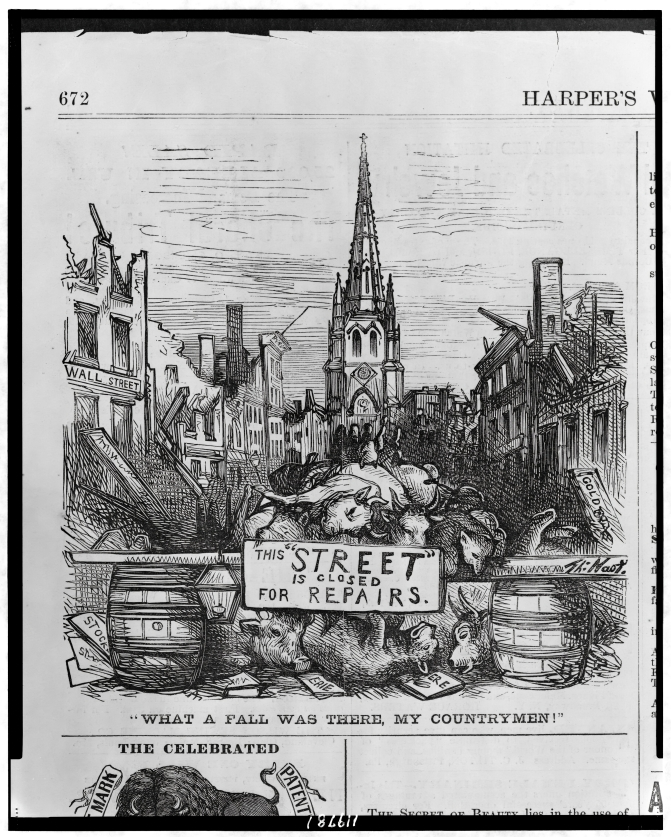

Within minutes of the Treasury announcement, the price of gold dropped from $160 a piece to $133 a piece. The stock market was also affected, dropping twenty percentage points in that same amount of time and causing horrific damage to many Wall Street Businesses and brokers.

The Economy Suffered, but Gould and Fisk Certainly Didn’t

The ripples from the Treasury announcement were felt in the economy for years. Foreign trade ground to a halt, thousands of investors were bankrupted, and one even committed suicide. Farmers may have been affected most of all, though, with wheat and corn harvests dropping in value by up to 50%.

The scandal plagued the rest of Ulysses S. Grant’s presidency, but, as in many stories of this nature, the conmen got away with little to no consequences. Jim Fisk managed to skirt the authorities by claiming that brokers made trades without his knowledge, and Gould got off even better. It’s rumored that his last-minute trades before the market crashed netted him $12 million, letting him get away with everything.