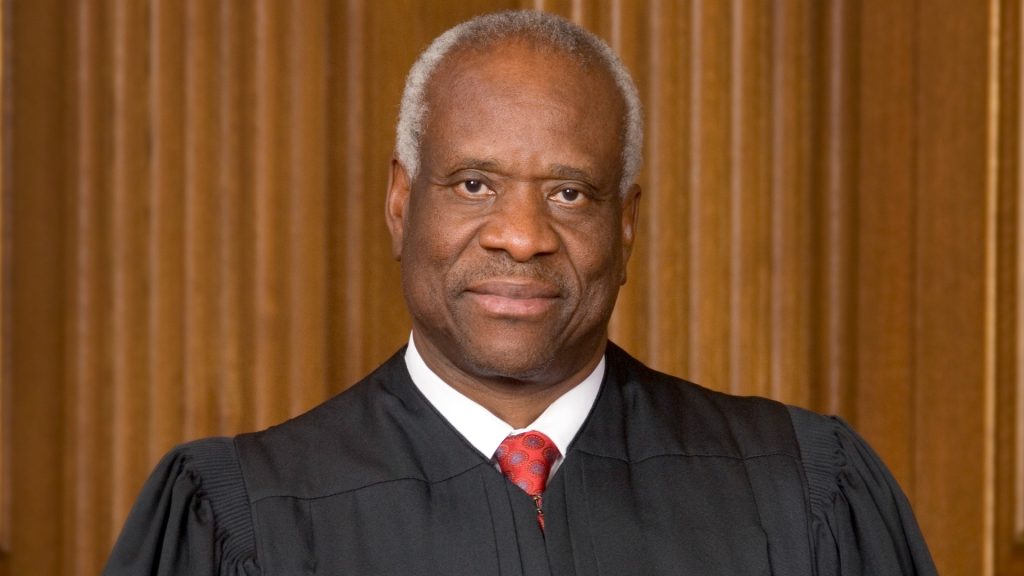

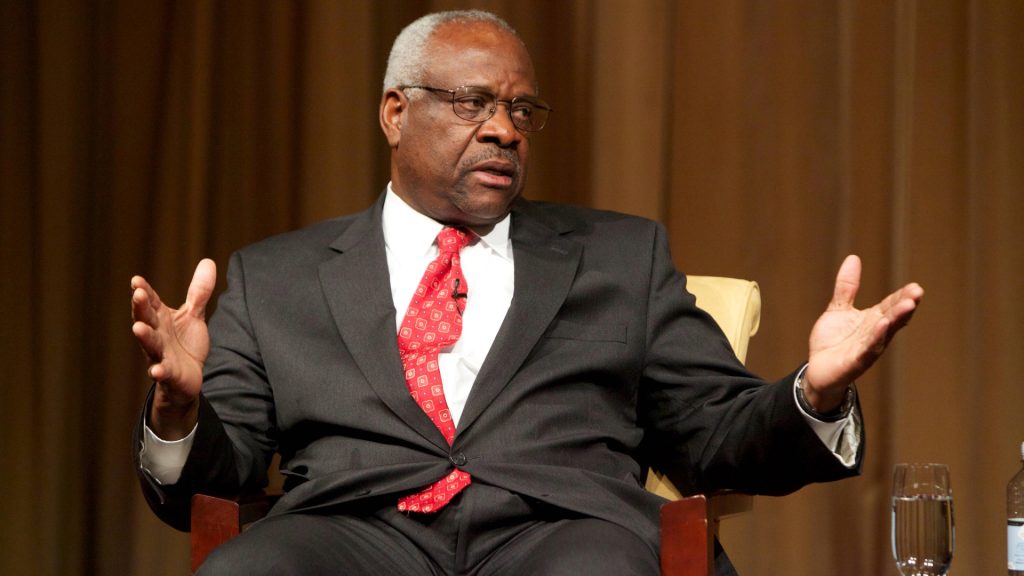

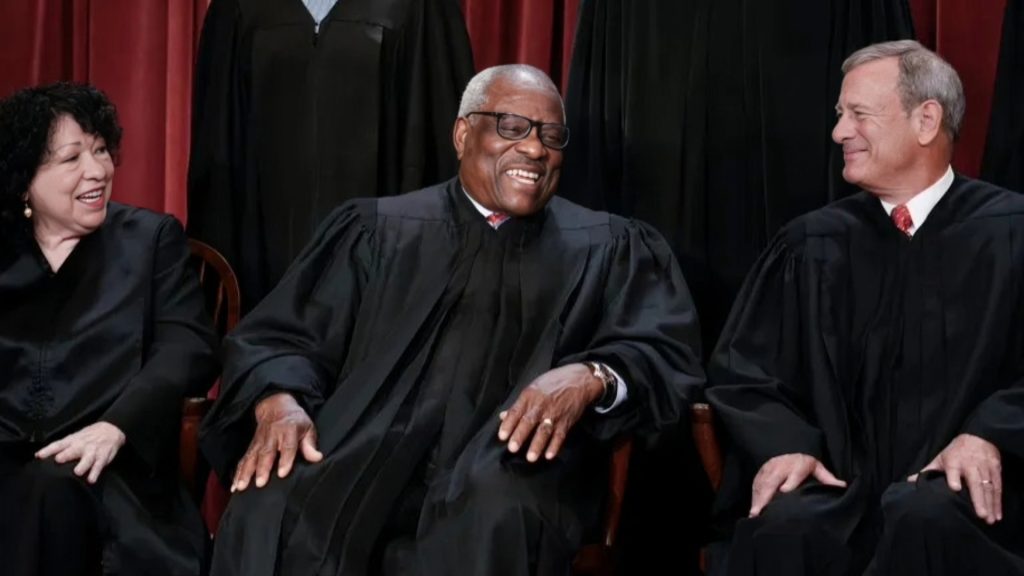

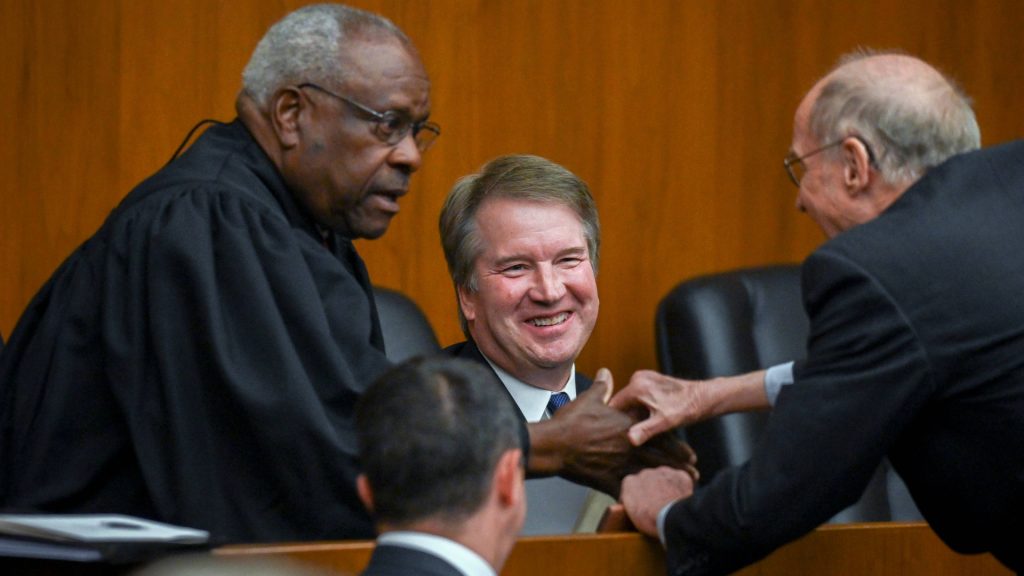

Supreme Court Justice Clarence Thomas is facing a lawsuit due to his confidential gifts, parties, and trips on private jets by conservative billionaires. This is about the ethical laws that declare the sources of gifts and give income tax for those holdings.

Castro, a Long-Shot Republican Presidential Candidate, Filing a Case

Castro, a candidate for the presidency by Republicans, said that he is filing a case against Supreme Court Justice Thomas in a Virginia court under the Virginia Fraud Against Taxpayers Act (VFATA).

As per reports, the Republican candidate asserted that it is subject to Justice’s false and fraudulent claim not to declare the source of gifts.

Is It Objectionable To Not Declare the Sources of Gifts?

Legal experts say that Justice Clarence Thomas denied the ethics laws to not disclose the billionaire’s gifts.

Additionally, Justice also avoided imposing such laws so that other Americans could pay taxes on gifts and donations. It is objectionable neglect and against the law to not require and regulate Americans to pay taxes on such donations.

Report of ProPublica About Luxury Gifts

ProPublica recently reported the commodities and items involved in the luxurious benefits for Justice Clarence Thomas by his benefactors.

The list includes private flights, loans for high-end RVs, opulent vacations, and school tuition.

What Statement Did Justice Clarence Thomas Provide About the Gifts and Luxuries?

Justice Clarence Thomas said that it was all due to the generous altruism of some friends when he threatened to resign from the job due to low perks and privileges in the form of salary.

In response to all criticisms and conversations around the lavish vacations, a vacation friend of Justice Clarence Thomas said that it was all just to supplement Justice’s “meager salary “.

How Brian Galle Criticized Justice Clarence Thomas

Brian Galle is a law professor at the Georgetown University Law Centre whose area of expertise is taxation.

He said, “If these benefits come as a supplement to support the income, then it becomes the regular pay to keep Justice on the court; regular pay is subject to regular tax enforcement.”

Clarence Thomas’s Statement Via Supreme Court’s public information Office

Thomas said that he had no regard for exchanging gifts to give favorable rulings. Thomas manifested that all the gifts he received were from the dearest old friends.

On the subject matter of his extravagant family trips, he said that as all friends join each other for trips, we have also joined them as a family trip because we have known each other for more than a quarter century.

What Is the View of the Supreme Court About Such Generosity?

The Supreme Court clarifies that only those gifts and donations are subject to tax-free, which belong to detached and disinterested generosity.

In the case of Justice Clarence Thomas’s gifts, it is clear that all conservative billionaires pay those gifts to stay judged on this position. So the gifts stemmed from interest and attached generosity – attachment is the retention of a judge on the highest court.

David Cay Johnston’s Arguments About the Clarence Thomas Position

David Cay Johnston is a visiting lecturer at Syracuse University’s College of Law.

He said that there is no history of removing a serving judge from the bench, but there is the probability of criminal prosecution against Justice Clarence Thomas. Furthermore, he argued that Justice falsified his financial ethics disclosure statement, which is subject to false filings and income tax fraud.

History of Ethics Law

In 1979, federal ethics law restrained from taking gifts for federal officials. All federal officials were forbidden to receive gifts if those gifts substantially affected the performance of official duties.

Reportedly, in the last three separate instances, Justice Thomas reversed his position, which directly benefited Crow and many other donors’ business interests.

Who is Harlan Crow, and What is His Role in Generosity for Clarence Thomas

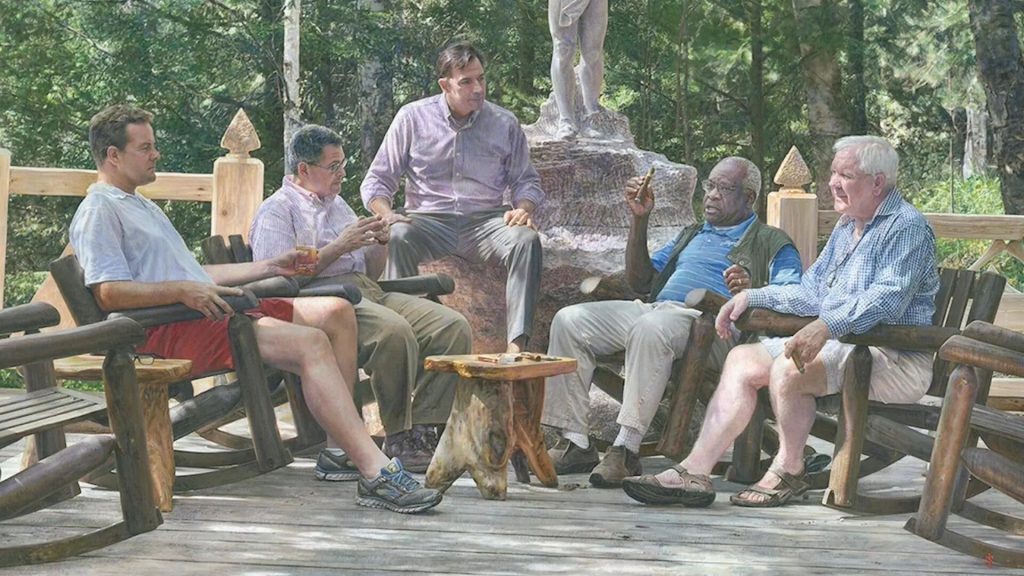

Harlan Crow is the Republican’s major donor. He is a real estate professional who also benefited from justice at an extended pace.

Justice Clarence Thomas has enjoyed several annual luxury trips on Crow’s dime. He also regularly stays at Crow’s private Adirondacks resort. Additionally, Justice with the family has trips to Bohemian Grove, which is a highly exclusive retreat in California.

Harlan Crow Has Magnificent Generosity for Justice Clarence Thomas’s Mother

Harlan Crow also benefited the other members of Justice’s family.

In 2014, Crow purchased a home for Thomas’s mother. Later on, the home was upgraded by Crow’s bid, and she continued living there.

US Gift Tax Laws and History

In 1924, US gift tax laws were established. According to this law, any money or property which is transferred from one origin to another is subject to gift tax.

Justice has given a personal nature to all gifts from family and friends, which makes it difficult to enforce the laws.

What Is the Legal Precedence About Gift Taxes?

Legal precedent over such contribution gifts drives out from the 1960 Supreme Court case Commissioner versus Duberstein.

This decision clarified that the exchange of gifts must be detached to avoid taxes. In the case of Justice Thomas, the motive is clear when Justice changes his position about Crow’s cases and other donors’ interests.

What Is the View of the Executive Director of Judicial Reform?

Gabe believes that it is difficult to establish fraud charges against Justice Clarence Thomas.

“With Thomas, it is difficult to connect the dots,” Gabe said in a statement. Moreover, he said that I can’t imagine a circumstance where Justice would be prosecuted because laws are only as strong as the government’s desire to prosecute.

The Prosecution of Thomas Can Set a New Precedent

Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy, said that such ethics reforms can bring new change.

This sort of precedent will primarily serve as ethical rules but not through tax rules. Questioning through ethical rules will fix the issue.