On Tuesday morning, the world woke up to the shocking and heart-stopping video of an out-of-control cargo ship crashing into a support structure, resulting in the catastrophic collapse of Baltimore’s Francis Scott Key Bridge.

The tragic accident cost the lives of six maintenance workers, closed the Port of Baltimore, and cut off a vital route into the city. It is quite a mess that will, in the end, cost billions of dollars to fix. Just who will have to pay this bill? A large chunk of it will land in the lap of an historic London group, Lloyds of London.

A Shocking and Destructive Accident

The Dali, a large container ship registered to Singapore, left the Port of Baltimore at 12:39 a.m. Less than an hour later, at 1:25 a.m., the vessel experienced intermittent power outages that left the pilot unable to control the steering or rudder. At 1:26 a.m., the pilot radioed for tug boat assistance.

Shortly after 1:27 a.m., the pilot ordered the anchor to be dropped. The ship’s pilot also contacted the Maryland Transportation Authority to say that the Dali had a blackout. Twenty seconds later, the pilot called back to say the ship had no power and was approaching the bridge.

The Collision and the Collapse

The transportation officer on duty immediately contacted its two units that were already positioned at the Francis Scott Key Bridge. Because of the construction and maintenance being carried out on the bridge, the units were already stationed on both sides of the bridge.

They were able to halt traffic on the bridge within seconds, a move that likely saved lives. Just after 1:29 a.m., the Dali, which was traveling at a speed of about 8 miles per hour, collided with the support structure beneath the Key Bridge. In a matter of seconds, the bridge snapped apart and collapsed.

A Transportation Nightmare

The Francis Scott Key Bridge is a major thoroughfare and until it can be rebuilt, Baltimore will experience a transportation nightmare. An estimated 4,900 trucks traversed the Key Bridge each day. Annually, more than $28 billion in goods are carried across the bridge on those trucks.

As Maryland governor Wes Moore explained in a press conference, the loss of this vital route will cause “significant economic damage not only to the region, but the entire country.”

Temporarily Closing the Port of Baltimore

Add to that nightmare the closure of the Port of Baltimore for an undetermined amount of time, and the financial impact is considerable. About $15 million in economic activity and transactions flow through the harbor each day.

As Governor Moore noted in his press conference, “We are talking about a port that’s responsible for over 51 million tons of foreign cargo. That’s the largest in the country.” Reopening the Port of Baltimore and rebuilding the Key Bridge will need to happen quickly so, as the governor puts it, the city can get “our economic engine going again.”

A Costly Accident

The accident will be inspected by insurance adjusters, but this incident will likely cost insurers billions of dollars. The Key Bridge itself is estimated to be worth approximately $1.2 billion, although the dollar amount will be much higher after potential liabilities are factored in.

This risk will, as we will see momentarily, end up on the desks of the oldest insurance exchange group in the world, the historic and venerable Lloyd’s of London. But what do we know about this organization, whose name is synonymous with high-dollar items?

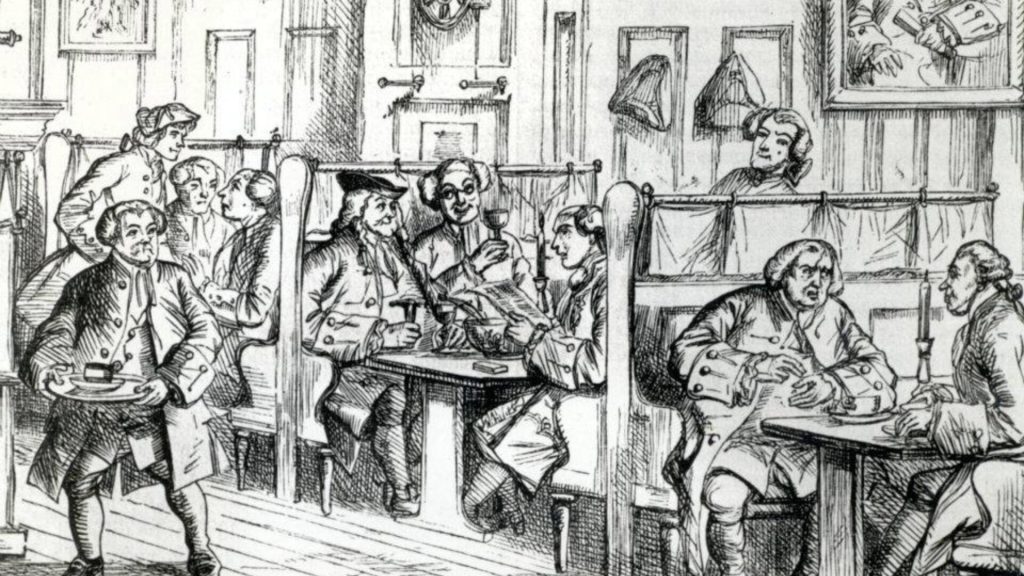

The Early Beginning of Lloyd’s of London

The roots of the prestigious and well-known Lloyd’s of London go back to the late 1600s. At that time, Edward Lloyd owned and operated a coffeehouse on Tower Street in London. This establishment was a gathering place for ship owners, sailors, and merchants.

Lloyd’s Coffeehouse attracted businessmen who were looking for the latest shipping news, hoping to close business deals, and wanting to discuss the challenges facing their industry. One of these issues was finding a way to insure the risks associated with maritime shipping. Edward Lloyd listened intently and issued the first written marine insurance policy in 1774.

What Is Lloyd’s of London?

It is easier to say what Lloyd’s of London is not, rather than what it is. It is not an insurance company like the company you use for your car and home insurance. Instead, it is an insurance and reinsurance marketplace for underwriters, most often groups, clubs, or syndicates.

This type of set-up means that Lloyd’s of London can assume risks on non-standard items that would be too complex for regular insurance companies to handle. It branched out from marine insurance to covering all types of items. Lloyd’s of London built a reputation for being a leader in the insurance industry.

The Dali Is Covered by One of These Clubs

The owners of the cargo being shipped by container vessels like the Dali are responsible for insuring that cargo, however the shipping industry carries its own insurance protection on the ship itself. That policy also covers damages that the ship may cause to third parties, like other ships or municipal infrastructure.

Groups of different shipping companies have come together to form “protection and indemnity clubs.” In a sense, the various companies agree to share liabilities. This way, a company won’t be forced out of business after an accident or loss.

Further Spreading Thin the Liability

These clubs are technically insurance groups. A club will take out several insurance policies and reinsurance policies to further spread thin the liability that could come from a catastrophic accident.

Basically, that means there are multiple insurance firms with policies owned by a shipping club that covers all its members. The Dali, we know, is part of the Britannia P&I Club. This happens to be the oldest one of these insurance groups … and one affiliated with Lloyd’s of London.

Lloyd’s of London Is Familiar with Large Maritime Catastrophes

As a major insurer of the marine industry, Lloyd’s of London is quite experienced at sorting out the claims from large maritime catastrophes. They covered the sinking of the Titanic in 1912, the Andrea Doria in 1956, and the Exxon Valdez in 1980.

In addition, they have handled the claims of other disasters and accidents, including the Great San Francisco Earthquake in 1906, the 9/11 Attacks in 2001, and Hurricane Katrina in 2005.

From Jewels to Legs to Satellites

Lloyd’s of London and its various firms insure risks on just about everything from jewels, satellites, and oil rigs to Betty Grable’s legs, Bruce Springsteen’s voice, and cricketer Merv Hughes’ iconic walrus mustache.

According to representatives from Lloyd’s of London, its policies represent more than $58 billion in annual premiums. That’s a big chunk of change … but the payout for the Baltimore Bridge collapse may take a bite out of this.

“One of the Largest Claims”

According to John Miklus, president of the American Institute of Marine Underwriters, the destruction of the Key Bridge could be “one of the largest claims ever to hit the marine reinsurance market.”

Experts put a $1.2 billion price tag on the bridge itself. The wrongful death claims for the six workers who perished in the bridge collapse could add another $700 million to this total. But that is just the start.

The Interruption of Business

Both the Port of Baltimore and the Key Bridge are closed indefinitely, causing interruption to business. Economists estimate that the port closure, on its own, will cost about $15 million per day. The closure of the bridge and other disruptions that the accident has caused could push this figure much, much higher.

An important shipping hub, the Port of Baltimore sees imports and exports of such items as cars, farming and construction equipment, and coal. All of these will have to be halted until salvage crews can remove the wreckage of the bridge and reopen the shipping lanes.

Estimating the Total Costs of the Accident

According to Marcos Alvares, a managing director for global insurance ratings for Morningstar, the total cost of the accident could land between $2 and $4 billion, “depending on the length of the blockage and the nature of the business interruption coverage for the Port of Baltimore.”

Another expert told Bloomberg, “While the incident still has to be investigated, we believe it has the potential to become a significant insurance claim, particularly in the marine market.” This expert echoes Alvares’ figures by estimating the cost to be around $3 billion.