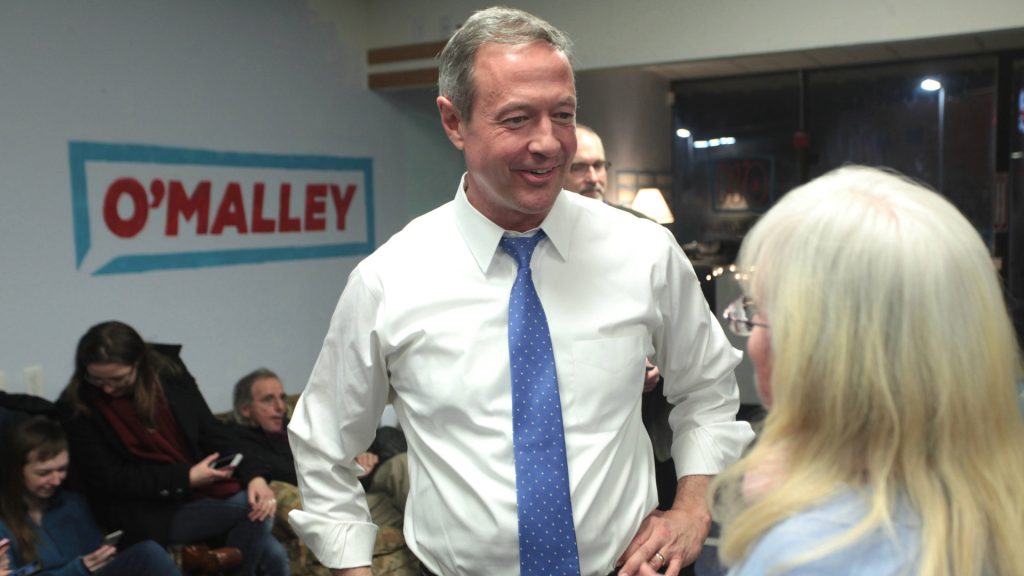

Social Security beneficiaries, rejoice! The days of having your benefits clawed back due to overpayment errors are over. This week, Social Security Administration Commissioner Martin O’Malley announced changes coming down the pike that will ease the burden on seniors who’ve been overpaid through no fault of their own.

Starting Monday, if you get hit with an SSA overpayment notice, you’ll see only a 10 percent reduction in benefits instead of the dreaded total cutoff. The SSA will now shoulder the burden of proving overpayments are the recipient’s fault before making deductions.

Low-Income Seniors to See Relief

Seniors who received overpayments of Social Security benefits due to errors will soon see relief.

According to the SSA commissioner, Martin O’Malley, the agency will reduce the penalties for overpayments, allowing low-income seniors to keep more of their benefits.

An End to Social Security “Clawbacks”

O’Malley announced an end to the SSA’s previous policy of “clawbacks,” in which the agency would intercept 100% of benefit payments to recover overpayments.

Starting March 25, the SSA will instead reduce benefit payments by only 10% to recover overpayments. O’Malley acknowledged that the previous policy often caused “grave injustices” by leaving seniors in dire financial circumstances when their benefits were suddenly cut off.

Burden of Proof on SSA For Any Overpayments

Additionally, the SSA will now have the burden of proving who is at fault for an overpayment rather than requiring recipients to prove their innocence.

Seniors will have an easier time applying for waivers if they believe the overpayment was not their fault. They will also have more time – up to five years instead of three – to repay any overpayments.

Easier Repayment Terms For Overpayment

In addition to curbing clawbacks, the SSA will make it easier for people to repay overpayments. Beneficiaries will have up to five years instead of three years to pay the money back, and the SSA will consider requests to waive overpayments altogether if recipients believe they were not at fault.

Alex Beene, a financial literacy instructor, said the majority of overpayment errors are the SSA’s fault, often unjustly harming low-income Americans.

The SSA Is Working to Improve

The policy changes are part of the SSA’s efforts to improve its services. Pennsylvania Sen. Bob Casey, who chairs the Senate Aging Committee, praised the new rules but said more must be done.

“It has to be remedied, not just for those in Pennsylvania and around the country who have been affected,” Casey said. “We’ve got to make sure this never happens again.”

Longer Repayment Offers An Opportunity to Appeal

The longer repayment period also gives beneficiaries more time to appeal the overpayment determination if they believe it was made in error.

They can submit additional evidence to prove the overpayment was not their fault or request a waiver of the charges altogether.

How to Apply for an Overpayment Waiver if Not Your Fault

To apply for a waiver, individuals will need to submit a written request to the SSA explaining why they don’t believe the overpayment was their fault.

They should provide as much detail as possible about the situation, including any records or documents that support their claim.

How Can Overpayment Happen

Some situations that may qualify for an overpayment waiver include the following:

Errors made by SSA staff, such as miscalculating a benefit amount or processing an application incorrectly.

Delays in processing critical information provided by the recipient, such as reporting a change in marital status.

Computer or system issues that caused benefit amounts to be calculated or paid improperly.

The recipient was unable to reasonably determine that the benefit amount was incorrect at the time payments were received.

Reduced Customer Service Wait Times

Currently, citizens face an average 38-minute hold time to speak with an SSA customer service agent. The commissioner acknowledged, “We are in a customer service crisis.”

To remedy this, the SSA intends to decrease wait times for those contacting the agency by phone.

Faster Decision Turn-Arounds For Disability Benefits

The SSA also plans to accelerate the determination of disability benefits. Applicants frequently encounter lengthy review periods that can span months or even years.

Commissioner O’Malley pledged that individuals with disabilities will receive “quicker decisions” on their claims going forward.

The New Changes Are More Than Welcomed

The announced changes aim to address pressing concerns, provide better service, and improve the overall functioning of an agency that millions of Americans rely upon.

By reducing wait times, speeding up disability determinations, limiting overpayment recovery periods, and enhancing customer service, the SSA hopes to better serve citizens who depend on its programs.

The Agency is Finally Listening

Commissioner O’Malley’s initiatives are an important first step towards improving the Social Security system and helping beneficiaries who have unfairly faced overpayment issues.

These changes signal that the agency is listening to the needs of seniors and working to provide a more fair and efficient experience.

A Big Win For Seniors

All in all, these changes are a big win for seniors who have unfairly shouldered the burden of Social Security overpayments.

The long wait times and clawbacks have caused undue stress, but now recipients have an advocate in Commissioner O’Malley.

A Common Sense Approach To Help Seniors

Commissioner O’Malley’s common-sense approach puts the responsibility on the SSA, not vulnerable beneficiaries.

With more reasonable repayment plans, an easier waiver process, and shortened hold times, Social Security recipients can finally feel heard. The days of seniors losing their financial security over an accounting error seem to be ending.