In a recent turn of events, Altria Group, the parent company of Marlboro cigarettes, has made waves by divesting a significant $2.3 billion stake in Anheuser-Busch InBev, the brewing giant behind Bud Light. The decision comes amidst a storm of controversy surrounding Bud Light’s advertising campaign featuring transgender influencer Dylan Mulvaney.

This move marked a pivotal moment for both companies, raising questions about Altria’s strategic direction and the implications for the beverage industry as a whole.

Explaining the $2.3 Billion Stake Sell-off

Altria Group, a significant player in the tobacco industry, recently made a decision to sell off a substantial stake worth $2.3 billion in Anheuser-Busch InBev, a major brewing company.

Altria’s decision to sell millions of shares in AB InBev is a big change for the company. They’ve been a big investor in AB InBev since 2016, owning up to 10% of its shares. But now, they’re selling some of those shares.

Brief History of Altria Group’s Investment

Altria Group stands as a prominent manufacturer of Marlboro cigarettes, holding a significant position in the tobacco market.

Beyond their tobacco business, Altria also ventures into various industries through strategic investments. Understanding Altria’s diversified portfolio provides context for their decision-making process regarding their stake in Anheuser-Busch InBev.

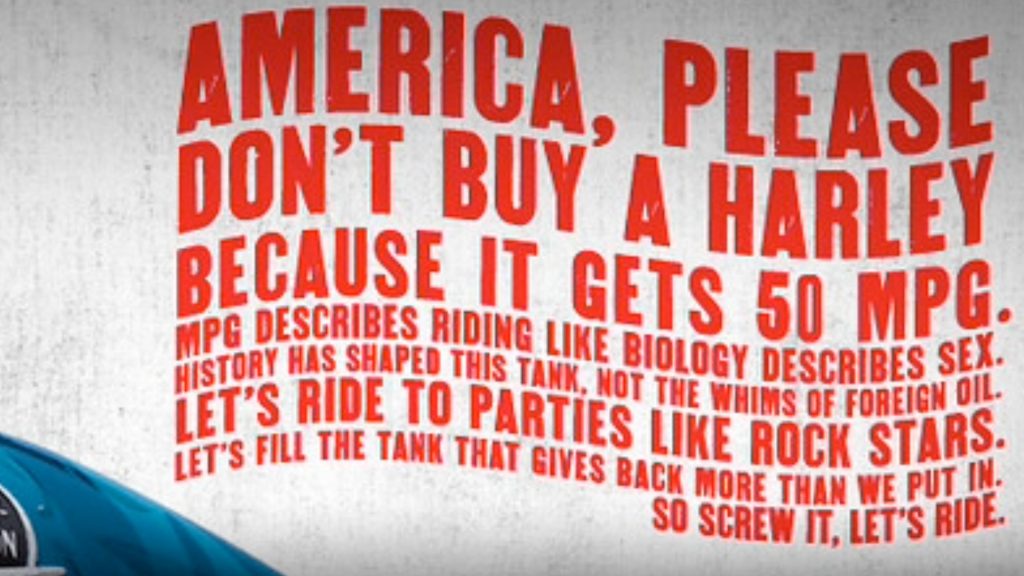

Bud Light’s Transgender Ad Campaign

Bud Light’s recent advertising campaign featuring transgender influencer Dylan Mulvaney sparked controversy across the nation.

The campaign faced backlash from certain segments of society, highlighting broader societal tensions around gender identity and representation in mainstream media.

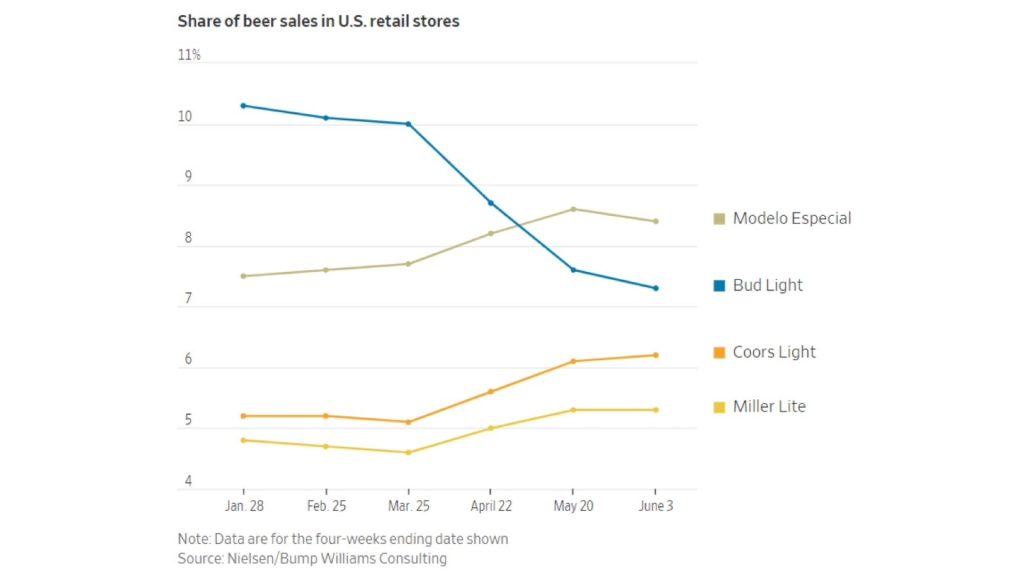

How Bud Light’s Ad Backlash Affected Sales

The campaign faced backlash from certain segments of society, highlighting broader societal tensions around gender identity and representation in mainstream media.

Analysis of sales data, consumer sentiment, and market trends provides insight into the tangible impact of the controversy on Bud Light’s bottom line.

A Look Back at Their AB InBev Stake

Altria’s involvement with Anheuser-Busch InBev dates back several years, with the acquisition of a significant stake in the company.

The sale of Altria’s shares in Anheuser-Busch InBev could have far-reaching implications for both companies and their stakeholders. It signals a shift in investment priorities and reflects the changing landscape of the beverage industry.

Understanding the Stock Market’s Reaction

The stock market responded swiftly to news of Altria’s stake sell-off, with implications for investor confidence, market volatility, and broader industry dynamics.

Altria’s decision to sell its shares in Anheuser-Busch InBev was primarily driven by financial considerations. The company saw an opportunity to capitalize on its investment and generate significant returns.

Billy Gifford’s Announcement Explained

Altria’s CEO, Billy Gifford, publicly addressed the stake sell-off, offering insights into the rationale behind the decision and the company’s strategic priorities.

In a public statement, Altria’s CEO, Billy Gifford, explained the decision to sell the shares as an “opportunistic transaction.” He emphasized the company’s confidence in Anheuser-Busch InBev’s long-term strategies and management team.

Addressing Backlash and Consumer Sentiments

In the face of public backlash, Altria Group navigated corporate responsibility by addressing concerns, upholding brand integrity, and maintaining stakeholder trust.

Evaluating their response offers lessons in crisis management and stakeholder engagement.

Impact on Bud Light

The controversy surrounding Bud Light’s ad campaign had tangible repercussions on the brand’s sales performance and consumer

Some people praised the ad for its inclusivity, but others were unhappy. Conservative groups and individuals criticized Bud Light for what they saw as an attempt to be “woke” or overly politically correct. Calls for boycotting Bud Light products began circulating on social media.

Discrepancies in Market Responses

Regional variations in market responses highlight the complex interplay between cultural norms, consumer preferences, and brand perception.

The sale of Altria’s shares in Anheuser-Busch InBev could have far-reaching implications for both companies and their stakeholders. It signals a shift in investment priorities and reflects the changing landscape of the beverage industry.

Examining Marlboro’s Role in LGBTQ+ AdvocacyHow Online Platforms Amplified the Issue

In the modern era, Marlboro faces increasing scrutiny over its role in social change, particularly regarding its engagement with LGBTQ+ issues.

While Marlboro has made strides in promoting LGBTQ+ inclusion and diversity, critics point to inconsistencies and contradictions in its approach.

Dylan Mulvaney’s Experience

The partnership with Dylan Mulvaney, intended to resonate with and support the LGBTQ+ community, instead highlighted the polarized responses brands can elicit when engaging with social issues.

The backlash from conservative segments and the criticism from LGBTQ+ advocates put Bud Light in a precarious position, impacting its market standing.

Public Figures’ Response

Celebrities also chimed in on the controversy surrounding Marlboro and the LGBTQ+ community.

Public figures like rapper Kid Rock, politician and Florida Governor Ron DeSantis, and NFL player Trae Waynes joined in on the public criticism and boycott. Their voices added to the public discourse, reflecting a diverse range of opinions on the matter.

Lessons Learned and Future Considerations

Despite the challenges and complexities involved, there is potential for collaboration between corporations and LGBTQ+ communities to drive positive change.

By fostering dialogue, building partnerships, and centering the voices and experiences of LGBTQ+ individuals, corporations can become genuine allies in the fight for LGBTQ+ rights and equality.